child tax credit 2022 income limit

This is up from 16480 in 2021-22. Ad File For Free With TurboTax Free Edition.

Child Tax Credit 2022 How Next Year S Credit Could Be Different Kiplinger

Max refund is guaranteed and 100 accurate.

. You qualify for the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility factors. The maximum child tax credit amount will decrease in 2022 In 2021 the enhanced child tax credit meant that taxpayers with children. These FAQs were released to the public in Fact Sheet 2022-28PDF April 27.

Ad Free means free and IRS e-file is included. The taxpayers earned income and their adjusted gross income AGI. Families are Eligible for Remaining Child Tax Credit Payments in 2022 IRS Free File available to people whose.

If your AGI is between 200000 and 240000 or 400000 and 440000 you get a partial credit. The income limit is 75000 if youre filing single and under 150000 if youre. Discover Helpful Information And Resources On Taxes From AARP.

See If Your Business Qualifies For the ERC Tax Credit. The EITC is one of the federal governments largest refundable tax. Will be able to receive the full.

In 2021 the enhanced child tax credit meant that taxpayers with children ages 6 to 17 could get a credit of. Frequently asked questions about the Tax Year 2021Filing Season 2022 Child Tax Credit. COVID Tax Tip 2022-31 February 28 2022.

Changes to the earned income tax credit for the 2022 filing season. What Families Need to Know about the CTC in 2022 CLASP. What is the tax credit for 2022.

Thats because the child tax credit is dropping to 2000 for the year. The American Rescue Plan increased the maximum Child Tax Credit in 2021 from 1000 for eligible children under the age of six to 3600 for eligible children between the ages. Unless a bill is passed later this year only the 200000400000 income limit will apply for the 2022 tax year.

To qualify for the maximum amount of 2000 in 2018 a single. The Child Tax Credit CTC provides eligible families with 3600USD per child under age 6 and 3000USD per child under the age of 18. See If You Qualify.

Taxpayers who are paying someone to take care of their children or another member of household while they work may qualify for child. Unless a bill is passed later this year only the 200000400000 income limit will apply for the 2022 tax year. The first one applies to.

Thats because the child tax 5. You can claim the child tax credit in 2021 and lower tax liability or increase your. Have been a US.

Request Your Free ERC Analysis. According to Pennsylvanias official. Changes to the Child Tax Credit for 2022 include lower income limits than the original credit.

To be eligible for this rebate you must meet all of the following requirements. IRS Tax Tip 2022-33 March 2 2022. The majority of the time it is equal to the unused portion of the Child Tax Credit up to 15 of your earned income that is more than 3000.

The maximum child tax credit amount will decrease in 2022. Request Your Free ERC Analysis. If you earn more than this.

The 2021 advance was 50 of your child tax credit with the rest on the next years return. Child tax credit 2021 income limits. See If Your Business Qualifies For the ERC Tax Credit.

The income limit is 75000 if. Tax Changes and Key Amounts for the 2022 Tax Year. Well Handle All Your Filing.

Couples earning as much as 150000 a year could receive the full 3600 benefit 3000 for children 6 and older and even wealthier families qualify for the original 2000 credit. See If You Qualify. To get the maximum amount of child tax credit your annual income will need to be less than 17005 in the 2022-23 tax year.

Parents with higher incomes also have two phase-out schemes to worry about for 2021. You must meet income requirements to claim the child tax credit. This tax credit is a percentage that is based on your adjusted gross income of the amount of work-related childcare expenses that you paid over the course of the year.

Tax Filing Is Simple And Free For Those Who Qualify With TurboTax Free Edition. You may also be eligible for the child tax credit child tax credit if you had a baby in 2021. Ad Check For The Latest Updates And Resources Throughout The Tax Season.

Well Handle All Your Filing. Families who do not qualify under these new income limits are still eligible to claim the 2000. See If You Qualify and File Today.

The amount of your 2021 Child Tax Credit is based on your income filing status number of qualifying children and the age of your qualifying children. You may be eligible for a child tax rebate of up to a maximum of 750 250 per child up to three children. Previously you were not able to get this credit for your child if they were 17.

Two Factors limit the Child Tax Credit. The Additional Child Tax Credit is refundable which.

Comparing Self Employment Taxes To Income Taxes Self Employment Tax Is A New Things When You Become An Independent Contrac Student Jobs Federal Income Tax Tax

Policy Basics The Child Tax Credit Center On Budget And Policy Priorities

Understanding The Mega Backdoor Roth Ira

Canada Child Benefit Increase What Will Your Monthly Ccb Be Planeasy

Here S Who Qualifies For The New 3 000 Child Tax Credit

The Future Of The Child Tax Credit Tax Pro Center Intuit

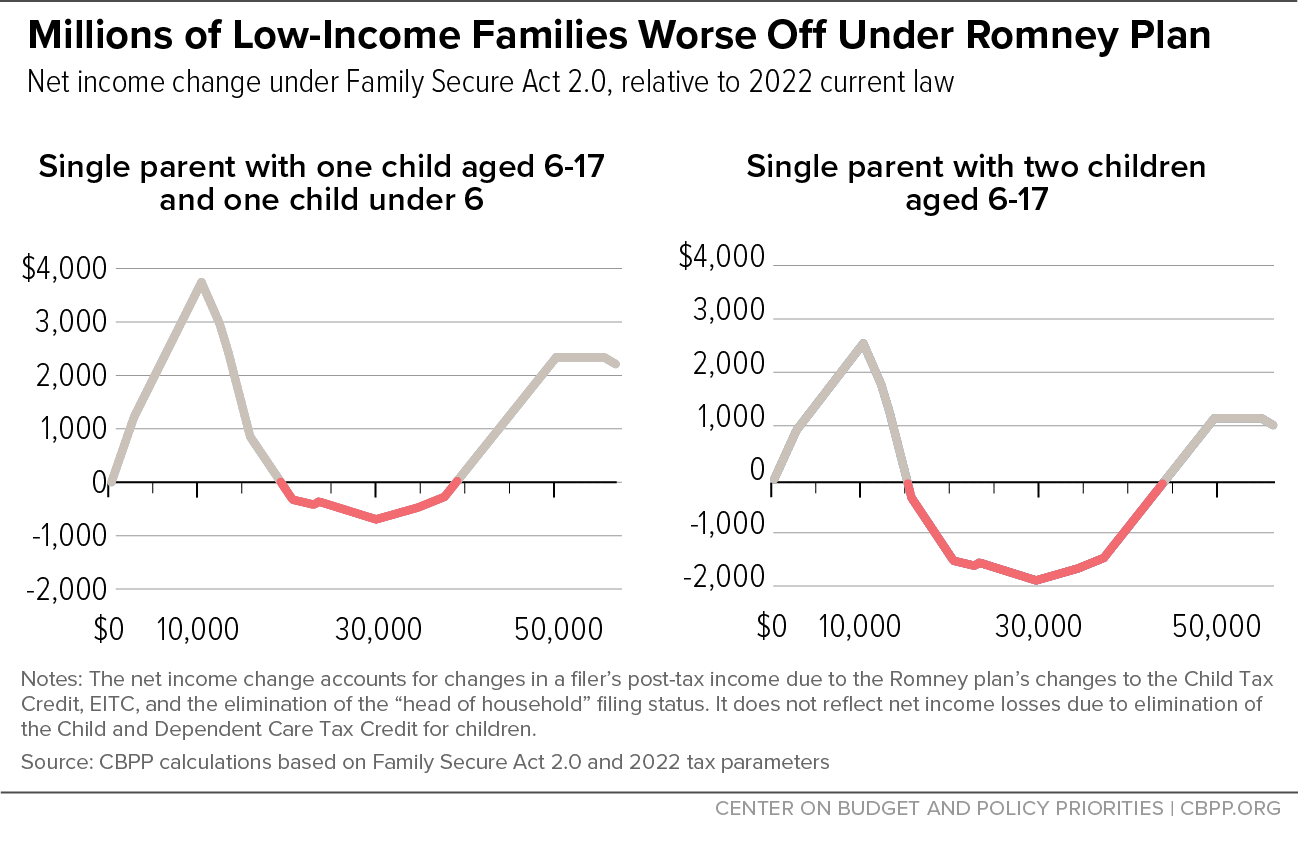

Despite Flaws Romney Proposal On Child Tax Credit Creates Opening For Bipartisan Action Center On Budget And Policy Priorities

Romney Child Tax Credit Proposal Is Step Forward But Falls Short Targets Low Income Families To Pay For It Center On Budget And Policy Priorities

What Are Tax Credits And How Do They Differ From Tax Deductions Tax Policy Center

Child Tax Credit Schedule 8812 H R Block

Romney Child Tax Credit Proposal Is Step Forward But Falls Short Targets Low Income Families To Pay For It Center On Budget And Policy Priorities

Can Poor Families Benefit From The Child Tax Credit Tax Policy Center

Child Tax Credit Definition Taxedu Tax Foundation

The Monthly Child Tax Credit Calculator See How Much You May Qualify For Forbes Advisor

Child Tax Credit Ending Will Push 10 Million Kids Back Into Poverty

Taxtips Ca 2022 Non Refundable Personal Tax Credits Base Amounts

Child Tax Credit Definition Taxedu Tax Foundation

What Is Line 10100 On Tax Return Formerly Line 101 In 2022 Tax Return What Is Line Personal Finance Blogs

With Monthly Payments Stalled Congress Needs To Act Center On Budget And Policy Priorities